Effectiveness of chatbots in Banks.

What is a Chatbot?

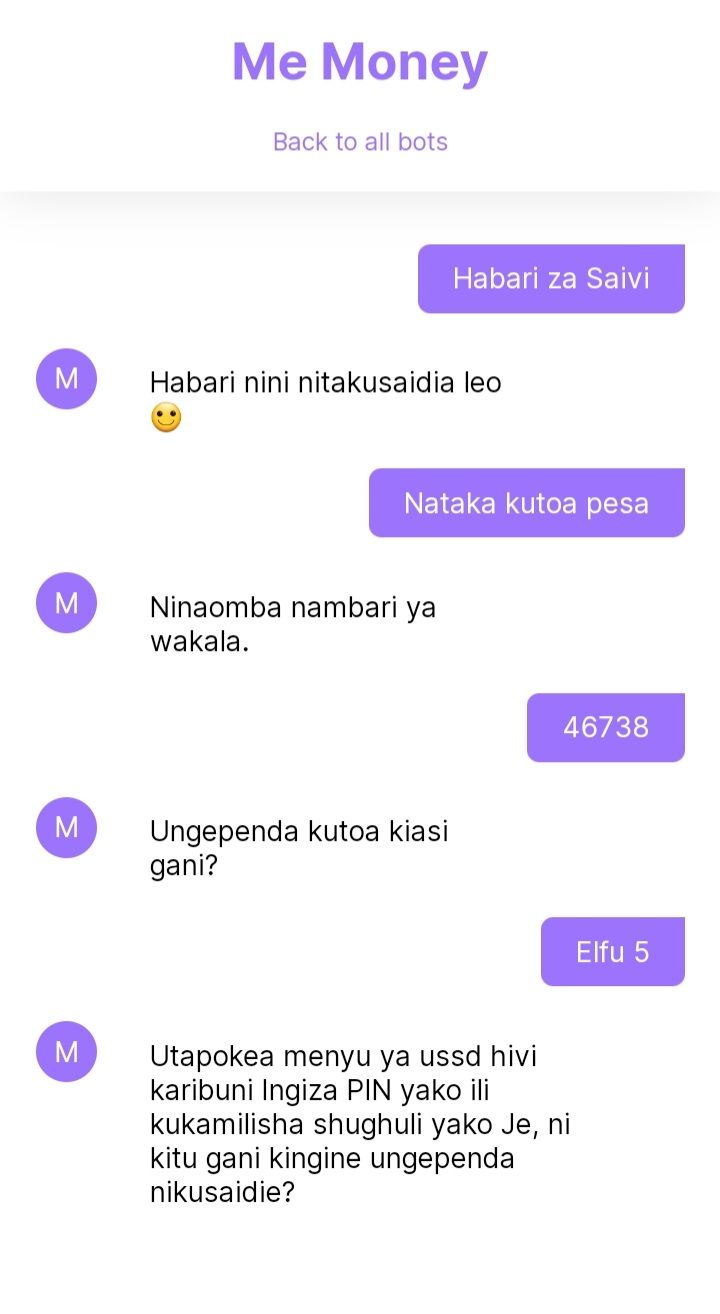

An artificial intelligence chatbot is a piece of software that simulates human conversation to provide a service or assistance. The most common application of chatbots is customer service, but they are also used in the financial institutions like banks to send money, withdraw money, checking bank account balance, verifying bill payments, setting up P2P Payment, Receive alerts for low balances or payment due, Notifying on expense crossing budget threshold and Receiving alerts for large transactions over threshold. Chatbots are programmed to mimic human conversation and can be used to automate certain tasks or provide information to customers.

The following are the statistics to prove the chatbot's effectiveness in banks and other financial institutions.

Nearly 90% of bank interactions (internal and external) are automated through AI chatbots. – Juniper Research

Banks can save up to 30% in customer support costs. - Chatbots Magazine

As per the latest data, close to 70% of customers prefer contextual conversations with chatbots. Since they can find answers to their questions much faster and the interactions are much more seamless, they would always pick bots over agents.

According to Juniper Research, banks will save 826 million hours through chatbot interactions in 2023. The same research firm also predicts that bots can save banks 4 minutes per inquiry, or a cost savings of $0.50-0.70 per inquiry.

64% of advisors with chatbots say that it allows them to spend more time solving complex problems, compared to 50% of advisors without chatbots -Salesforce, 2019.

43% of customers deal with their banking problems by using a chatbot rather than going to their branch - Humley, 2018. This convenience is a clear advantage offered by chatbots.

As per the reports by Juniper Research, the operational cost savings from using chatbots in banking will reach $7.3 billion globally by 2023, up from an estimated $209 million in 2019. Chatbots offer 24/7 support besides providing instant customer support, increasing customer satisfaction.

61% of executives say that conversational bots enhance employee productivity via automatic follow up of scheduled tasks. (Accenture, 2018)

Chatbots are projected to handle 75-90% of healthcare & banking queries by 2023

Chatbots handle 68.9% of chats from start to finish.- Chatbots are getting more and more advanced every year. According to the latest data from Comm100, chatbots were able to handle 68.9% of chats from start to finish on average in 2019. This represents an increase of 260% in end-to-end resolution compared to 2017 when only 20% of chats could be handled from start to finish without an agent’s help.

68% of consumers like chatbots because they provide quick answers.

The #1 benefit of chatbots is 24/7 support, according to consumers

Wrapping it up

That concludes our roundup of the top chatbot statistics in that financial industry.

Now, you can have a chatbot for your banking institution from us Neurotech Africa and lead the competition.

Contact us: info@neurotech.africa , +255 757 294 146